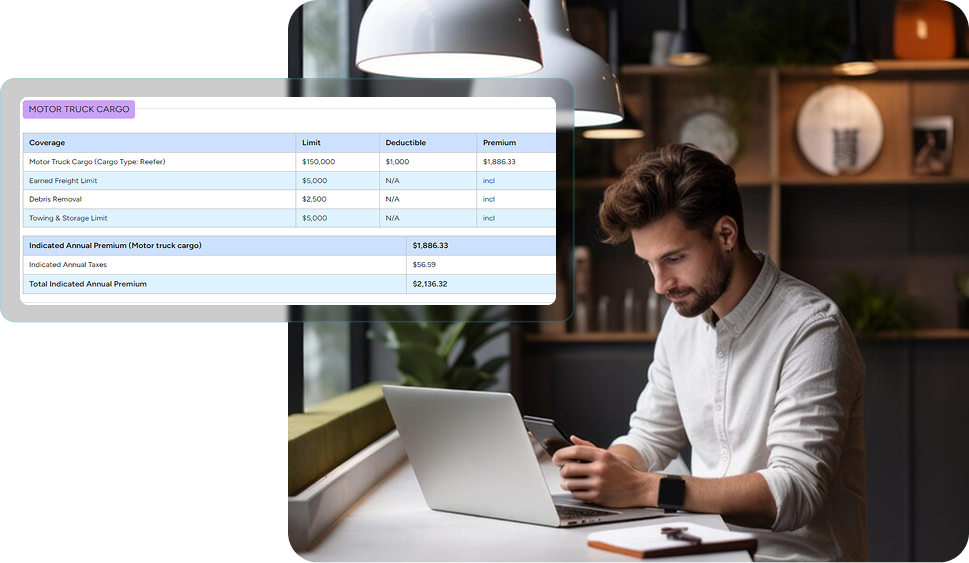

Motor Truck Cargo

- Complete Insurance Solutions

Cargo & Trailer Exchange

Comprehensive coverage for your commercial trucks including collision,

comprehensive, and specified perils protection.

Powered by Innovation

Our platform brings cutting-edge technology to commercial trucking insurance

Automated Processes

Streamline customer credit activities and workflows with accurate payment tracking.

Cloud-First

Use a scalable and secure cloud infrastructure that supports growth and ensures your business is always up-to-date.

Smart Configuration

Customize the system to your specific needs with simple, easy-to-use configuration tools and policy workflows.

Analytics

Install Make informed decisions about key touch points and improve your results with analytics integrated right into your workflow.

Total cloud-native coverage for trucks

Available Endorsements

- Towing/Storage Limits from $5k-$25k

- Overhead Striking Coverage

- Debris Removal

- Earned Freight

- Refrigeration Breakdown

Online Policy Management Features

- Quote to Bind

- Process Endorsements

- Agency Branding

- eSign Policy Documents

Coverage

- Physical Damage

- General Liability

- Cargo

- NTL

- Trailer Interchange

Motor Truck Cargo Insurance, Coverage for Your Shipment

Get a free quote today and covers the cargo while in transport

Motor Truck Cargo Legal Liability Insurance, also known as Cargo Insurance, covers losses or damage to the commodities that truck drivers are carrying. This coverage begins when the driver takes possession of the cargo, as evidenced by the Bill of Lading, and continues until the cargo is delivered and signed for at its destination. Truck drivers are responsible for the cargo they are carrying, so it is important to have Cargo Insurance to protect themselves from financial losses in the event of a claim.

Essential Coverages in a Trucker’s Cargo Policy

Choosing the right coverages for your cargo policy is crucial to ensure you are fully protected. While lower-cost policies may be tempting, they might lack essential coverages. Here are some key coverages to consider:

Pollution Liability

Covers costs to clean up spilled goods like gasoline.

Debris Removal

Covers costs for removing cargo dropped onto roadways and waterways.

Theft and Hijacking

Covers losses from burglary or hijacking of goods.

Sue and Labor Coverage

Covers further losses from damaged goods after an incident.

Earned Freight Coverage

Covers income lost due to damaged cargo that can’t be delivered.

Infidelity/Dishonesty Coverage

Covers losses from theft committed by the driver.

Water Damage

Covers losses from trailer leaks and wetness.

Loading and Unloading Coverage

Covers losses during the loading and unloading of cargo.

Reefer Breakdown

Covers losses associated with refrigeration equipment malfunction.

Protect Your Trucks Today

Get comprehensive physical damage coverage with limits up to $250,000.

Our team is ready to help you find the right protection for your fleet.