Auto Physical Damage

- Complete Insurance Solutions

Auto Physical Damage, Protect what's Yours.

Comprehensive coverage for your commercial trucks including collision,

comprehensive, and specified perils protection.

Powered by Innovation

Our platform brings cutting-edge technology to commercial trucking insurance

Automated Processes

Streamline customer credit activities and workflows with accurate payment tracking.

Cloud-First

Use a scalable and secure cloud infrastructure that supports growth and ensures your business is always up-to-date.

Smart Configuration

Customize the system to your specific needs with simple, easy-to-use configuration tools and policy workflows.

Analytics

Install Make informed decisions about key touch points and improve your results with analytics integrated right into your workflow.

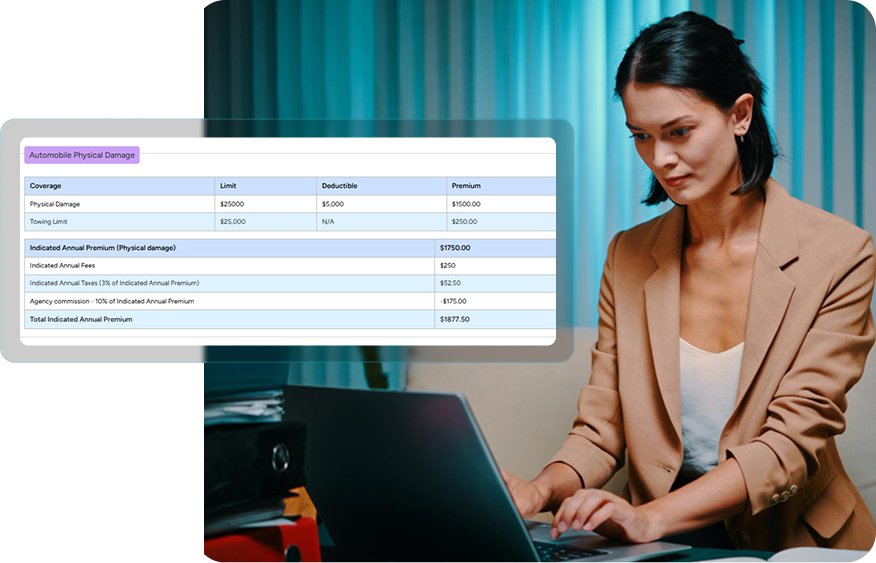

Total cloud-native coverage for trucks

Online Policy Management Features

- Quote to Bind

- Agency Branding (Coming Soon)

- Process Endorsements

- E-Sign Policy Documents

Coverage

- Physical Damage

- Cargo

- Trailer Interchange

- General Liability

- Non-Trucking Liability

What is physical damage insurance?

Physical Damage Insurance is coverage for your truck and trailer. This insurance coverage is for repair or replacement for damage resulting from things such as collision, fire, theft, hail, windstorm, earthquake, flood, mischief, or vandalism to your owned vehicles. Pricing is based on the value of your equipment and usually pays a percentage of that value. Physical damage coverage may be required by the lien holder of your vehicle.

This coverage comes in the following three parts

Collision

This coverage protects you against the event of a rollover or a collision. This policy is comparatively more expensive than comprehensive coverage because accidents are riskier as well as costlier than damages.

Comprehensive

This policy offers coverage for the majority of physical damages to the truck in incidents like vandalism, fire, theft, and animal contact. Additionally, when your truck goes beyond repair it compensates for its replacement as well.

Fire and theft with CAC

This coverage is specially designed for heavy-duty trucks that give complete protection against many potential risks on and off the road (combined additional coverage).

Protect Your Trucks Today

Get comprehensive physical damage coverage with limits up to $250,000.

Our team is ready to help you find the right protection for your fleet.